Cyber Underwriting and Threat Intelligence

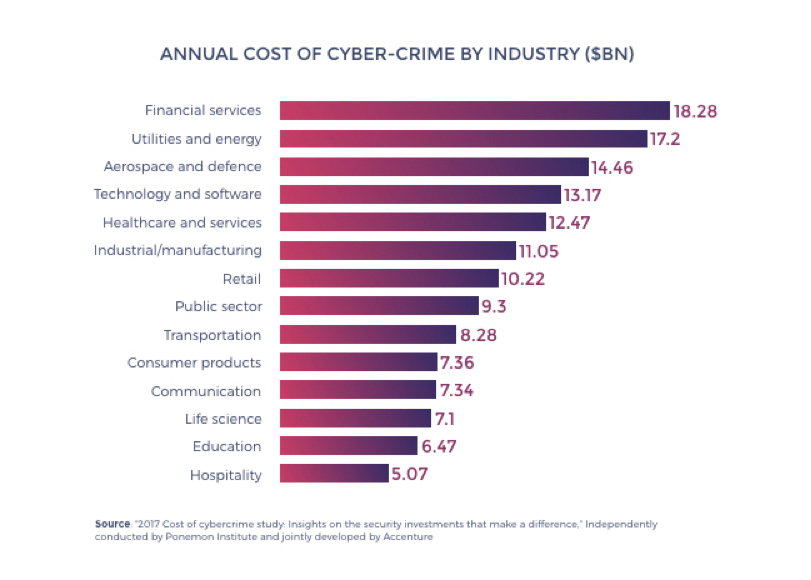

Insuring against cyber-threats – including denial of service attacks, ransomware and cyber-terrorism – represents an exceptional opportunity and challenge for the insurance industry. Cyber-insurance is a fast growing market need, yet the nature of threats is becoming exponentially more complex and unpredictable.

Meanwhile, there are obstacles to cyber-insurance carriers, brokers and customers interacting as effectively as possible about coverage planning, policy underwriting, risk monitoring, and claims processing:

To support a cyber-insurance carrier’s growth, BlackSwan Technologies offers its software: ELEMENT™ of Insurance – Cyber Edition. It combines the latest technologies for Big Data, Artificial Intelligence, Cognitive Computing and Contextual Analytics into a quick to deploy business application that increases customer satisfaction and carrier profitability.

The product includes three essential components:

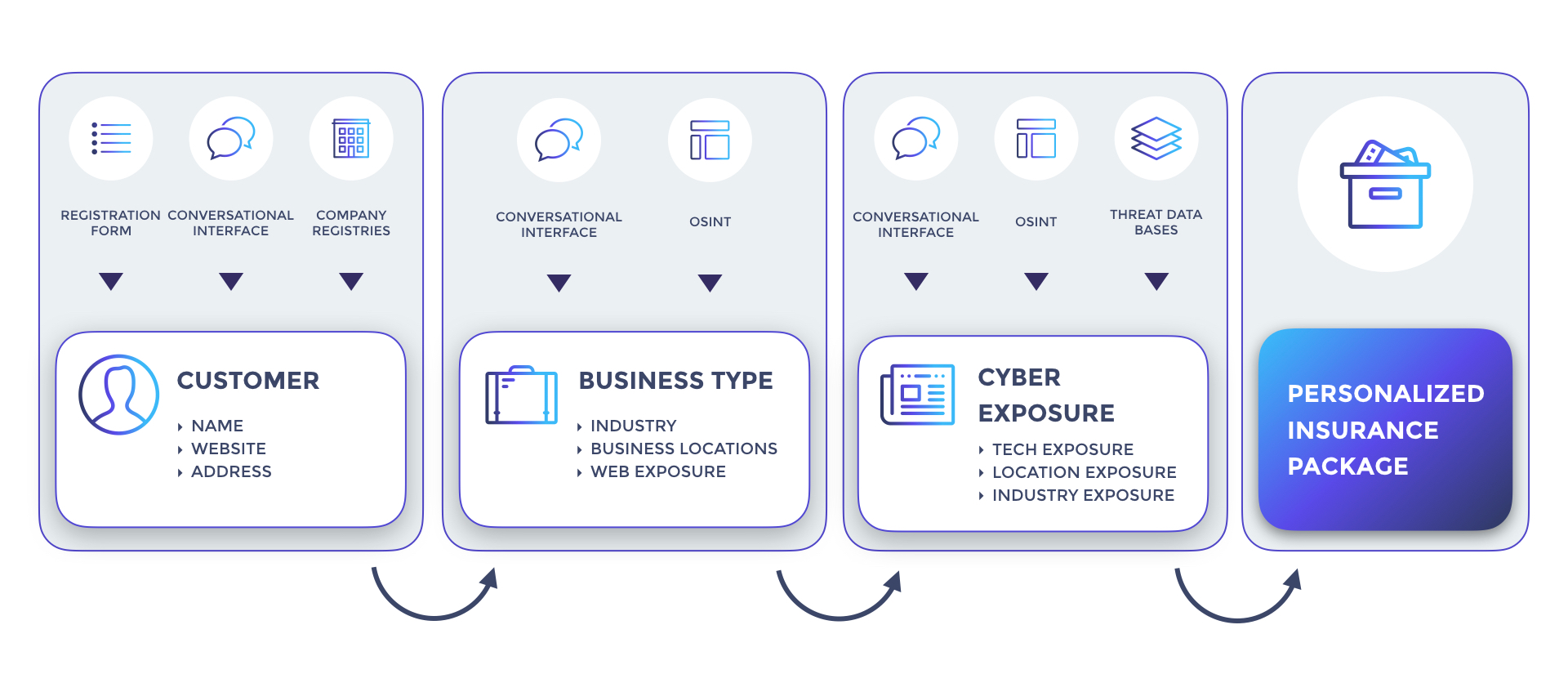

When compiling information about a prospective cyber policy holder for underwriting, information is automatically extracted from existing customer databases, guided chat, ingestion and interpretation of unstructured documents and a range of public sources of company insights. This is combined with open source intelligence (OSINT) and threat database details to benchmark the organization’s exposure based on factors including industry, location and installed technologies. Deep/machine learning and contextual analytics engines predict risks, evaluate the economic consequences, and display this in an insightful manner for the agents, brokers and underwriting. As illustrated below, the result is a personalized insurance package that thoroughly addresses the organization’s needs and that meets the carrier’s latest underwriting guidelines for cyber-threat protection.

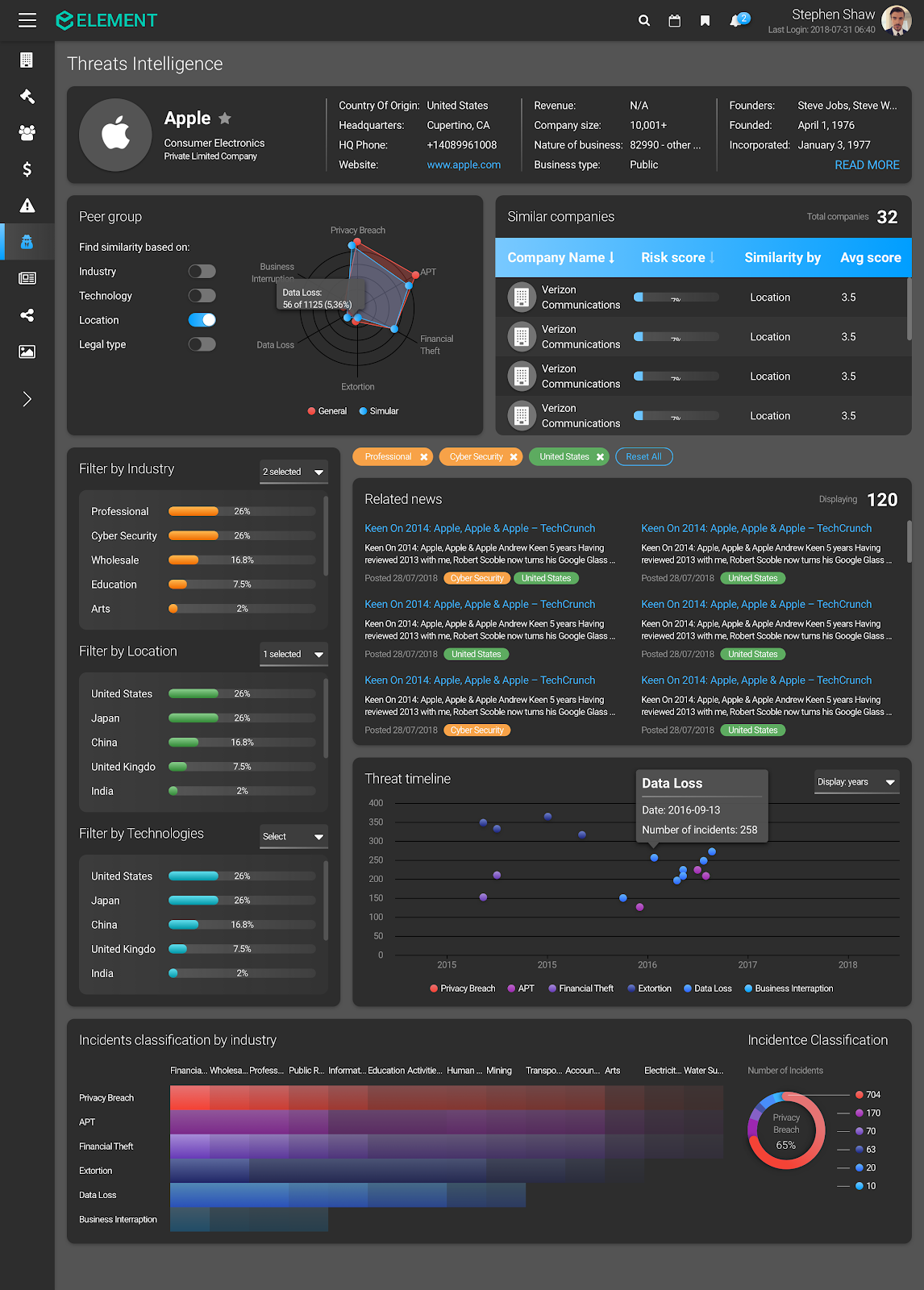

The insurer’s agents and brokers interact with the customer, as well as underwriting, risk management and claims, through their own visual workspace. Information about the latest global cyber-threats that could affect the customer are displayed, integrated with case management information and customer interaction records.

The cyber-insurance solution is based on ELEMENT™, our Enterprise A.I. Operating System. At BlackSwan, we consider A.I. to mean “Augmentation and Acceleration of your organization’s Intelligence.” Extensible, A.I.-enabled processes can digest reams of data streaming from a variety of sources and transform them into situational awareness at your team’s fingertips.

ELEMENT™ combines an array of the most advanced AI technologies, including entity extraction, knowledge graphs, network/relationship analysis, machine learning and predictive analytics to form its contextual picture of the cyber-threat environment. Add to this: rule-based AI recommendations, chatbots with natural language processing for flexible queries and document interpretation, and big data processing and data visualization to empower staff, brokers and customers, with greater insight into alternative actions. The result is Cognitive Computing Out of the Box for rapid realization of game-changing business results.

ELEMENT™ is truly enterprise-class in terms of integration options with an insurer’s back-office systems, centralized configurability of logic, and granular access control by user-type and data element. In fact, ELEMENT™ of Insurance – Cyber Edition is a specialized version of ELEMENT™ of Insurance, which can enhance a carrier’s operations across insurance lines and all core business functions.

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.