Jun. 09, 2020

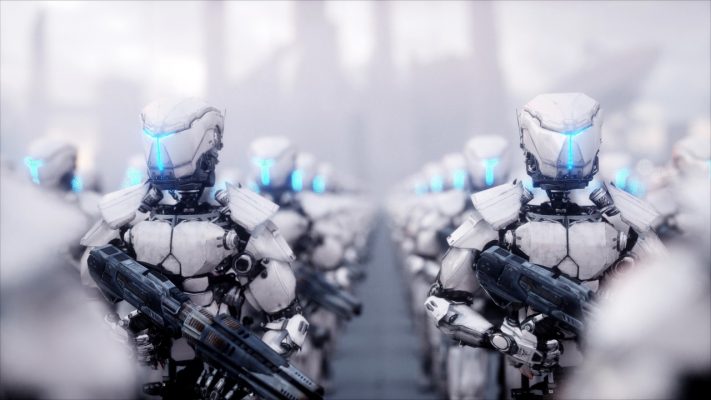

Banks BEWARE! Digital troopers are at the GATE

Liron Golan @BlackSwan Technologies

Let me start by sharing a story that we may all be familiar with about two back-packing friends who were on a camping adventure. One of them ran into the tent and shouted to his friend that a bear was running towards them. The other friend quickly started to put on his running shoes. As he began to lace up his shoes, his partner was incredulous and asked how on earth, he thought he would be able to outrun the bear.

His response is very instructive, ‘I do not have to run faster than the bear, I only have to run faster than you’ – Survival Tactics lesson 101.

So, where is the bear, and why do you need to run?

Our world is currently undergoing several transformations, all converging at once and co-occurring, forcing disruption and change.

Worldwide spending on digital

transformation technologies will reach $2.3

trillion in 2023, more than half of all

ICT spending

DIGITALIZING IS EVERYWHERE

First and for most, a digital transformation process, a general term that encompasses a profound and accelerated transformation of business activities, processes, competencies, and models to fully leverage the changes and opportunities of digital technologies and their impact across society in a strategic and prioritized way.

Every business today is going digital; Starbucks is probably the poster child organization for digital transformation. The company’s Mobile Order and Pay rollout have juiced sales. Its apps are driving sales velocity, and technology partnerships are bolstering the vibe in Starbucks’ locations.

The digital transformation is powered by an unprecedented data transformation, the way that organizations and individuals mine, process, understand and take action on data, using the growing power of Analytics and Artificial Intelligence (#AI) machine learning (#ML) capabilities, that are becoming more and more powerful, user-friendly and ubiquitous.

Finally, a significant infrastructure transformation that is also a major business paradigm shift, with the move to the #cloud, changing on how services and applications are consumed, paid for, and maintained.

All these transformations are shaking the core of the financial industry.

It is no longer business as usual- Forrester calls, “The age of the customer.” And in this era, there is clear evidence that consumer behavior and expectations regarding service and experience are changing.

The new technologies are changing the way customers and financial service providers interact and introducing a new demand for how banking services are delivered.

The Theory of Disruptive Innovation presciently explained that fast-moving disrupters entering the market with cheap, low-quality goods could undermine companies wed to prevailing beliefs about competitive advantage. In the past decade, however, disrupters have changed dramatically, says this week’s guest. They now enter the market with products and services that are every bit as good as those offered by legacy companies — and make it harder than ever for traditional businesses to compete

Corresponding to Darwin’s principle of natural selection, I call this phenomenon Digital Darwinism. (#DigitalDarwinism)

The laws of nature equally apply to the business world: digitalization rapidly changes technology and society and forces companies to adapt fast enough – or die.

Despite their best efforts, most mainstream banks are fighting just to keep up with the unprecedented pace of technological change — and too many are falling behind. Banks everywhere are grappling with slower growth, tightening regulation, and are struggling to reduce their operational costs.

So now that we understand who is the bear, and that it is approaching – how should banks fight back…and put on their running shoes?

A NEW BREED OF COMPETITORS

Mainstream banks have much to learn from the nimble, digital disruptors offering the trusted, transparent services that today’s customers increasingly seek, all built on a lean, asset-light business model.

These digitally-driven challengers operate from a different playbook.

These agile, innovative banks will also be more customer-centric and organize their businesses around customer segments, rather than around product categories. Moreover, these players harness the latest technologies to leverage innovation quickly and offer new offerings.

The days in which it could take a week to open an account are over.

Banks that do not craft a meaningful response risk losing customers — and revenue – to other, more digitally focused financial services providers.

The advantage you had yesterday will be

replaced by the trends of tomorrow. You do

not have to do anything wrong, as long as

your competitors catch the wave and do it

RIGHT, you can lose out and fail.

TIME TO PUT ON THE RUNNING SHOES

To cater to the new breed of customers, banks need to harness the latest technology to their aid and embrace digital transformation to its full.

Digital Transformation, and the introduction of advanced analytics, specifically artificial intelligence (AI), are changing this paradigm. By minimizing the dependency on labor-intensive tasks, efficiency is increasing in orders of magnitude; processes become a thousand times faster, and marginal transaction costs are nullified. At the same time, the customer journey is drastically improved, as processes shorten, and interaction becomes personalized.

By 2023, 60% of organizations will need to

implement new data and model management

solutions to support artificial intelligence (AI)

projects

Gartner

Only the ones who adapt to their new environment will survive.

By genuinely focusing on customer needs and integrating data, and analytics insights with product development, banks can transform not only the service proposition they offer to their customers but also the perceptions of their brand.

WHERE TO START

I believe that digital transformation is a journey, and like every journey, the most challenging part is taking the first steps.

As a starting point, banks must adapt to the new conditions and strengthen existing ones. They need to redefine their business boundaries and develop a culture of innovation, taking into account the ecosystem of customers, employees, and partners.

They need to harness technology to their aid, creating a Customer-centricity culture, to become part of their customers’ digital lives — working with third parties to make their products and services relevant in multiple contexts.

They need to become agile and dramatically improve efficiency and business processes. From a total cost of ownership (TCO) perspective, banks should explore a native SaaS solution. Such a solution can utilize all the benefits of the cloud – accessible from anywhere and secured by design.

Last, to avoid ‘rip and replace’ situations, banks should build a bridge between the old back office and new digital tools. The latter is a technology layer that serves as an “adapter” between the legacy system and new digital tools, allowing banks to overhaul their back-office virtually.

HOW BLACKSWAN-TECHNOLOGIES CAN HELP

Our goal at BlackSwan Technologies is to democratize data-technologies. Driven by the latest advances in Cloud Engineering, Artificial Intelligences, and Cognitive Computing, Our AI-Operating system, offers a complete white box framework, allowing full configuration of every aspect from data acquisition via AI-based processing to data monetization.

Our unique schemaless infrastructure enables businesses to design and define their bespoke ecosystem, including entities, properties, relationships, risks, rewards, and opportunities highlighting their market value proposition and way of doing business.

Our AI-based operating system allows companies to become domain-agnostic – to explore new applications and new domains with zero development. Our unique capability empowers companies to connect to any data source internal, external, structured, or unstructured, seamlessly, and with minimal effort.

Our offering is trusted by some of the largest global banks and can be operated as a Managed Service by global consultancies, MSPs, and System Integrators

Learn more at www.blackswantechnologies.ai or follow us on Twitter and on LinkedIn