Jun. 02, 2020

Is today’s AI ready to impact Financial Services?

Gregor Duschkin @BlackSwan Technologies

Recently, I realized it is now slightly more than 10 years ago that I had the pleasure and privilege to speak at the Euro Finance Week by dfv Mediengruppe (@dfv_de) in Frankfurt, Germany. So, I thought it would be a good idea to reflect on the journey since.

Looking Back

Back then, we shared thoughts about how 4 mega forces, namely Emerging Economies, Demographic Shifts, #Technology Ubiquity and Accountability & #Regulations were influencing the world of business and the #FinancialServices Industry. We assessed that we were seeing, again, 4 key shifts in enterprises’ priorities: Firstly, moving from considering cost as a barrier to growth to seeing it as fuel for growth; secondly, moving from customer loyalty through good service to customer loyalty through #Innovation; thirdly, moving from spending money for information to making money through information and, lastly, from winning on the straight to winning in the turns.

Sounds familiar? 10 years later, much of this is still true. And while we have, arguably, made much progress across the board, helped by substantial technological developments, and also the learnings of several crises since, we are finding ourselves still discussing many topics related in one way or the other to the above points.

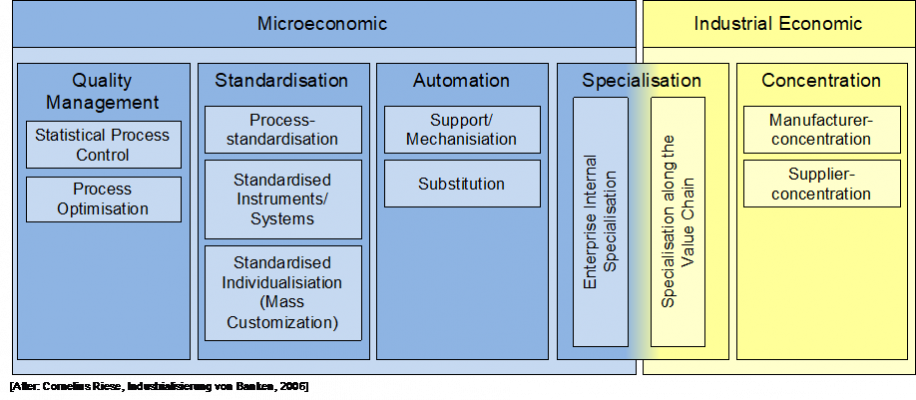

Much progress was made, undoubtedly, in many #Microeconomic areas. There is especially one point though, raised in our discussions at the time, which – while subject to many continued discussions and stronger or weaker attempts at finding solutions for it – remains unsolved to quite a degree: How do we manage to generate #Industrial #Economic #Impact?

As we can see, the discussion dates back a long time. Now, what is impeding concepts like Managed Services, #Utilities and the likes, and keeps them from really taking off and deliver on the great opportunity to truly generate Industrial Economic Impact. I will readily admit, there are huge businesses and revenues generated in these areas. However, they appear still to be very much present in the Microeconomic areas of the above diagram.

Quite a few industries, e.g. manufacturing, have evolved strongly in the amber areas of the diagram. I do not want to dwell on a discussion on Manufacturer Concentration in #FinancialServices as this would lead way out of the purpose of this point of view – and it is a huge, complex discussion in itself. I would only say that I remember one of my professors at university, who, back in the late eighties, was advocating that this concentration would be inevitable. We have seen some of this, largely driven by the Financial #Crisis, but it will be really interesting to see how this will evolve further. Especially now that we will still have to see the full impacts of the #COVID-19 pandemic.

How much has changed – and if not, why?

However, where do we see strong Supplier Concentration, and that in combination with a specialization along the value chain? Or in other words, where are the system manufacturers of dashboards, gearboxes, drive trains and the likes in the Financial Services Industry? Yes, there are some, e.g. in Payments and in Cards and Securities processing. There have been, and are, some attempts, larger or smaller, in #KYC, and I am sure there are more.

But have they really been lifting off? Have they really made an impact in the way they have e.g. in #Manufacturing? At least some doubt must be permitted. I have had the opportunity to be involved in quite some #ManagedServices and Utility initiatives, and two key challenges were always quite apparent:

One, Managed Services and related #BPO initiatives were mostly designed to be – apologies for using an exaggerated term for this – yet another version of “your mess for less”, with a bit of process optimization and digitalization built into it. In reality, most, if not all these activities, were and are heavily confined to the Microeconomic areas.

Two, Utilities have almost all focused on following the example of classic utility companies, or, to be a bit provocative, “the same mess for all for less”. They rarely catered to the fact that not all need the same water. Deviations almost immediately result in either eroding commercial viability for the utility company, or huge cost increases for the client(s) – thus eroding the business case.

So, how can we make substantial strides towards resolving the challenge to create Industrial Economic impact?

And how will advanced technology help us?

May I offer a view that first of all, we need to start thinking differently altogether: Why are other industries so much farther advanced? In my view, because they have mastered thinking in production platforms and shared supplier infrastructures. And the suppliers making up these shared supplier infrastructures have mastered to produce customized versions of (often quite complex) products or systems to meet multiple, different requirements of their clientele. In many cases, they take on responsibility for #R&D and innovation as well – alone, or in partnerships with their clients and sometimes even their own competitors.

Their clients, on the other hand, have come to the realization that they can probably not be the leader of the pack in the design and construction and packaging of all of the individual components which make up their product. One of the obvious examples: The automotive sector, especially in Germany. Yes, it thrives on the strength of its large manufacturers, but more so even, on the brilliance of the supplier and systems partner ecosystem, they permitted to evolve, and even helped create.

So now, let us look into Financial Services and assess if anything comparable really exists. In my view, not. The reasons cited for this are myriad and one can read so much about them. Some better, some not so good a read.

But I often wonder why there is not more thinking in this discussion as in #GeorgeBernardShaw’s brilliant:

“Some men see things as they are and ask why. Others dream things that never were and ask: Why not?”

Say, who would have thought differently shaped Watermelons can serve a purpose?

What would it then take to bring up such an “Industrial Economics” ecosystem in financial services?

We would need, one, an ability to create flexible production lines which would allow for multiple financial services institutions to have customized components of their value chain built on this production line, two, the ability to quickly bring innovation to these components, and three, the willingness to let go of the control of the “how” and focus on the “what” and “when”. In an ideal scenario, this will include giving the power to create and co-create specific solutions and optimization to component suppliers.

Interestingly, a true game-changer for the Microeconomic activities would be if we could build an information ecosystem which would allow us to overcome siloed approaches like one point technology for this, one for that, another data lake for that, and a humongous systems integration effort to keep all of these components working together, with regulators sometimes wondering who really still has an overview of all of this system environment mushrooming.

See the connection? What will help Industrial Economic optimization will also help Microeconomic optimization and vice-versa? The problem is, however, what solution(s) are there to make any of this real? Have #Cloud, #AI, and “Digitalization” brought us forward dramatically? Apart from raising all kinds of other issues like #DataSecurity, #DataPrivacy and what not more?

Arguably yes, but I never felt like there was a truly solid universal approach or a universal technological solution based on data, knowledge, insights and wisdom. We seem to always get caught in the same challenges. So, can technology really help us play a different game? Can we truly transform based on AI and cloud technologies? How would that work?

Whom to turn to for executable solutions?

Some large companies have paved the way with their input, and obviously all the big players like @Google, @Microsoft (by the way, I love the #philanthropic attitude and vision of @Bill Gates), @Amazon are driving this transformation, and I have seen quite some #niche and smaller enterprises with great, innovative ideas and solutions.

Two years ago, I came across a company which claimed to be capable of things we at the time thought to be either impossible or outrageously tedious and costly to achieve. More, they claimed to be usable as a point solution, an enterprise application or a full #AI operating system. It would be cross-functional, supporting any structured, unstructured, semi-structured, public or private, paid and unpaid data sources, fully customizable workflow orchestration, multi-tenancy, #GDPR and other data protection regulations compliant, client outreach capable, machine learning native, and most importantly, #Schema-less, using Bring Your Own Schema technology, #White-boxed, Pure #SaaS\PaaS and #CloudAgnostic, and based on the intelligence of knowledge graphs. Wow.

My initial reaction at the time was: “Impossible – But, if it is true, it will fundamentally change what we can do and indeed allow a different game. It will permit the manufacture of the equivalents of dashboards, gearboxes, drive trains and so much more. It will allow us to actually have a production line for multiple different customers. And, it will also allow us to use the data we possess for many different purposes. It will be an #iOS for any enterprise and open the door for improved holistic microeconomic transformation, and more so, Industrial Economic optimization – certainly for the financial services industry.”

Learning more, I realized that the re-thinking behind this company’s vision is indeed radical. Not only does it apply principles of intelligence services to industry, it goes as deep as to assess, assuming your computer was Cloud, what should its Operating System look like. A fundamental rethinking of what we were accustomed to for years is at the core of a project named #CAIOS (stands for Cloud AI Operating System to highlight deep connection with managed AI capabilities), which is currently conducted by BST LABS as an internal Open Source Project within @BlackSwan Technologies. I would highly recommend reading a related paper by @Asher Sterkin which I recently shared on LinkedIn.

And I started to think this in the logic of a continuing #KYC utility discussion which has not yet found a true resolution. Imagine you have the capabilities quoted above, limitless ability to consume data sources, the ability to create a KYC production line which is flexible to cater to any institution’s specific requirements and design, including outreach and automated Event Driven Reviews (#EDR), allowing to expand to and integrate multiple other components like #AML, Transaction Monitoring, and more, in the sense of the equivalent of the component or system supplier in the automotive sector. And regulators would love the transparency and control this would imply.

The full circle

Suddenly, Industrial Economic optimization becomes a reality. And, better even, it allows using exactly the same principles for other areas of the financial services manufacturing process. Leverage the data and analytics for Sales, Research, Model Management and other applications you may be thinking of. Use an Operating System which leverages clouds as computers and be able to create your own, highly flexible applications landscape.

And that brings me back to where I started with this 10 years ago: With evolution this dramatic in technology, we now get the ability to really play a different game. No faster horses, but automobiles with different brands, models and specifications as desired by customers, built and delivered profitably using best in class component manufacturers.

Cost will become fuel for growth. Customer loyalty through innovation becomes a reality. We finally get to really make money through information. And, by the sheer flexibility and limitless options, we can start winning in the turns.