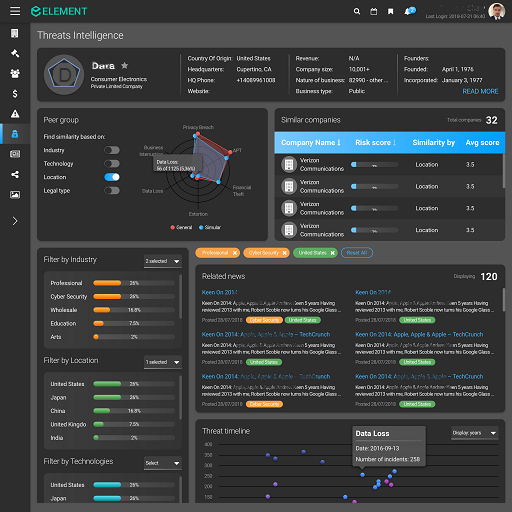

Cyber Insurance Underwriting

VALUE PROPOSITION

The reinsurer, operating in a highly competitive market, with a wide variety of brokers, was seeking ways to differentiate itself from the competition, by improving the customer journey

The company was embarking on a wide digital transformation effort, introducing automation, increasing efficiencies, and improving data quality and governance. The cyber underwriting line of business, where demand is soaring, but processes are complex and labour-intensive, was chosen to champion the transition

To read more about ELEMENT™ and Underwriting CLICK HERE

BlackSwan Technologies is reinventing enterprise software through Agile Intelligence for the Enterprise – a fusion of data, artificial intelligence, and cloud technologies that provides unparalleled business value. Our multi-tiered enterprise offerings include the award-winning platform-as-a-service, ELEMENT™, which enables organizations to build enterprise AI applications at scale for any domain quickly and at a fraction of the cost of alternatives. BlackSwan and its global partners also provide industry-proven applications that are ready-made and fully customisable for rapid ROI. These offerings are generating billions of dollars in economic value through digital transformation at renowned global brands. The private company maintains gravity centers in the UK, Europe, Israel, the US, and Sri Lanka.