Transaction Intelligence

VALUE PROPOSITION

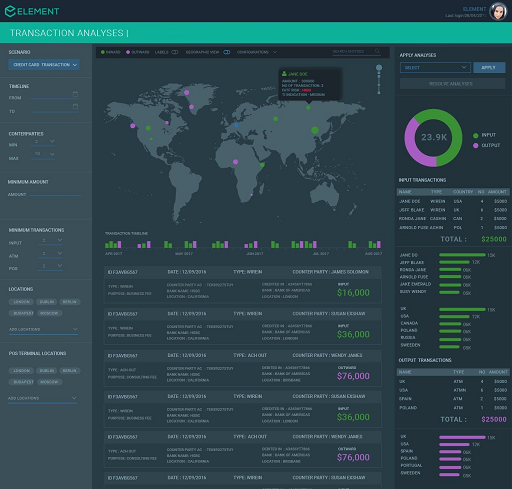

High cost of operation – Anti-Money Laundering (AML) alert generation, alert triage and case investigation processes were largely manual, with very high rates of false positives (appx. 99%)

Legacy systems had limited automation and configuration capabilities, no self-learning capabilities, no entity enrichment from external (open or paid) sources, and no visually-assisted ability to explore related transactions and entities, resulting in manual investigation processes

High false-positive rates due to legacy, deterministic rules-based scenarios. Rule-based legacy monitoring systems produced many unproductive or low-productivity alerts and scenarios

Manual work procedures and multiple sources of data led to biased, segregated cases with limited or no feedback loop from operations

To read more about ELEMENT™ of Compliance CLICK HERE

BlackSwan Technologies is reinventing enterprise software through Agile Intelligence for the Enterprise – a fusion of data, artificial intelligence, and cloud technologies that provides unparalleled business value. Our multi-tiered enterprise offerings include the award-winning platform-as-a-service, ELEMENT™, which enables organizations to build enterprise AI applications at scale for any domain quickly and at a fraction of the cost of alternatives. BlackSwan and its global partners also provide industry-proven applications that are ready-made and fully customisable for rapid ROI. These offerings are generating billions of dollars in economic value through digital transformation at renowned global brands. The private company maintains gravity centers in the UK, Europe, Israel, the US, and Sri Lanka.