Bank Compliance

VALUE PROPOSITION

A global bank with US$100 billion in assets was concerned about ongoing exposure and frustrated with the growing costs of complying with Know Your Customer, Anti-Money Laundering and related customer-activity regulations.

Both false positives and false negatives were an issue for Compliance. One industry study found that 75 – 85% of the AML alerts raised at banks turn out to be false positives, for example, where two similarly-named entities might have been mistaken for each other. More concerning were false negatives, as relationships with questionable parties might not be discovered without particularly time consuming research. This shortcoming had repercussions for the bank’s reputation and its exposure to potential penalties.

The compliance costs of fully vetting new clients during onboarding were exceeding 7% of total expenditures. This was partly due to the amount of manual research and compilation of information from different sources involved. With base of 4 million customers and growing, the bank determined that controlling onboarding and monitoring expenses was a priority.

The existing technology framework for compliance incorporated a limited number of data sources – primarily the bank’s financial transaction systems plus watch lists. Traditional data screens displayed situational information in field-and-value format. Although Compliance and FIU were organized into a combined unit, they worked with separate systems.

The bank discussed with BlackSwan the need to take a more advanced, comprehensive approach, applying Cognitive Computing capabilities to reduce risk exposure, compliance and technological costs.

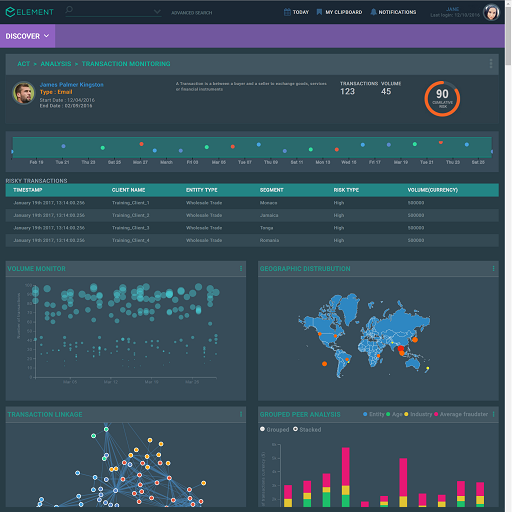

BlackSwan Technologies’ ELEMENT™ of Compliance application was deployed to provide more comprehensive information about customers and their profiles, activities and business environments, more accurate identification of customer situations to flag for follow-up; and a visual dashboard to allow compliance staff to monitor and act on a large number of situations in parallel. The software is an industry-specific application built on ELEMENT™, our Enterprise Intelligence Operating System. It was designed with the involvement of compliance officers to exceed current industry best practices.

At the heart of the application is an contextual analytics engine that scans all available private and public data sources for information about a business or individual, and maps that party’s relationships to all other known parties. Databases about a party’s profile and transactions are coupled with a scan of news about that party to look for any changes in situation or reputation. The collective insights from hundreds of banks’ experiences are screened to remove confidential information then encapsulated into ELEMENT’s knowledge base, in order to recognize questionable behavior and quantify its risk level.

At the time of onboarding, an adaptable KYC workflow built into ELEMENT™ ensures that all the required questions and any pertinent follow up information capture is posed to the prospective customer. Thereafter, all customer transactions are monitored and alerts are automatically sent to the appropriate level of staff, based on a configurable quantification of risk.

To read more about ELEMENT™ of Compliance CLICK HERE

BlackSwan Technologies is reinventing enterprise software through Agile Intelligence for the Enterprise – a fusion of data, artificial intelligence, and cloud technologies that provides unparalleled business value. Our multi-tiered enterprise offerings include the award-winning platform-as-a-service, ELEMENT™, which enables organizations to build enterprise AI applications at scale for any domain quickly and at a fraction of the cost of alternatives. BlackSwan and its global partners also provide industry-proven applications that are ready-made and fully customisable for rapid ROI. These offerings are generating billions of dollars in economic value through digital transformation at renowned global brands. The private company maintains gravity centers in the UK, Europe, Israel, the US, and Sri Lanka.