KYC on Demand

A distributed workforce capable of working from anywhere is a new reality of many global organizations today. But working remotely, particularly when onboarding new clients or selling regulated products, brings with it a hefty dose of compliance challenges.

In addition, many financial institutions are fighting just to keep up with the breakneck pace of technological change, with many back-office systems and processes simply not designed for remote access.

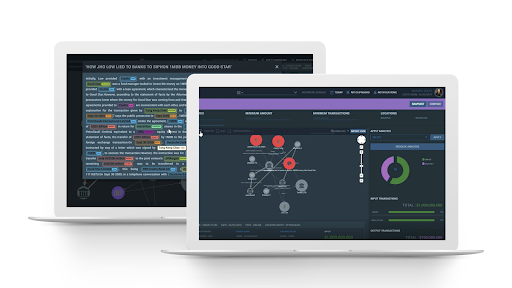

Know Your Customer (KYC) on Demand is a high-performance, high-security global solution that enables secure remote access from anywhere in the world to complete business-critical KYC checks for retail, private and corporate clients.

Trusted by Europe’s largest banks, KYC on Demand utilizes cognitive computing, Artificial Intelligence and Knowledge Graph technologies for best-in-class data acquisition & enrichment, and driving automatic analytical insights and predictions.

Vital data obtained during KYC functions as seed for enrichment from millions of structured and unstructured sources such as a high credential, open and restricted sources, global news, and other internal and external data sources. Ensuring immediate and complete information is included in the screened entity’s KYC profile

Liron Golan – Head of Marketing, interviews Lior Perry – Chief Engagement Officer and Michal Pilorz – Head of AML, about the present challenges related to KYC process. They also discuss a practical example of a successfully implemented solution.

Reducing TCO and improving in time to compliance

Via remote access and simple and quick integration to your existing KYC processes

FOCUS ON WHAT MATTERS MOST

FOCUS ON WHAT MATTERS MOSTWith an up to 65% reduction in alert volume, you can better manage risk by predicting and acting on AI-powered insights

Unprecedented scalability, reliability, and security on a single platform

With a 99.9% guaranteed availability and no downtime for maintenance

SECURE BY DESIGN

SECURE BY DESIGNNetFoundry provides Software-only, Zero Trust, performant and reliable connectivity to KYC on demand

A FULLY MANAGED SERVICE

A FULLY MANAGED SERVICEOffload your KYC program onto our business partner experts.

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.