ELEMENT of Compliance – Adverse Media Monitoring

What once was leading-edge in the world of Know Your Customer regulations and practices has now become an expectation. Adverse Media Monitoring (AMM), otherwise known as negative news screening, is an essential element in identifying risks inherent in a customer, or business associate, relationship. AMM covers news reports, legal and financial filings, social media and blogs, and more. Not all solutions provide adequate support, however. Effective AMM reflects the following challenges:

Many risks emerge gradually, through circumstantial mention, well before red flags and investigations are triggered. Risk monitoring must be proactive and ongoing.

Without interpretation technology intelligent enough to accurately identify causes for escalation, the immense daily volume of commentary generates noise and costly false positives.

Associates of customers are not automatically identified, and institutional business partners are neglected in the enterprise’s media monitoring.

Regulators have come to expect AMM practices are in place at financial institutions, placing time pressure on institutions to introduce the latest technology in short order.

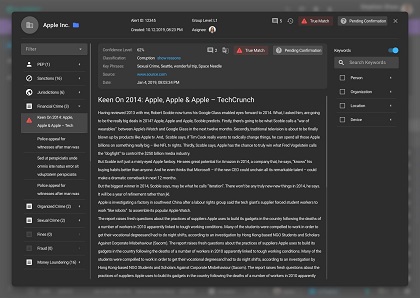

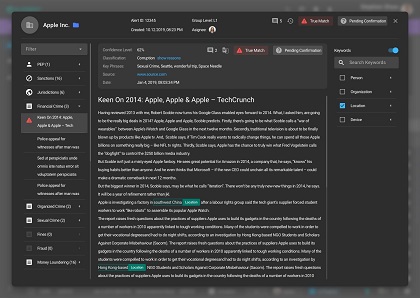

BlackSwan’s Adverse Media Monitoring incorporates composite artificial intelligence, big data and business workflow technologies to provide the most comprehensive, accurate and valuable insights to efficiently manage risks identifiable within media. A key emphasis is on reducing false negatives and false positives in media mentions and allowing one’s analysts to more effectively address critical or nuanced situations.

Human-like interpretation

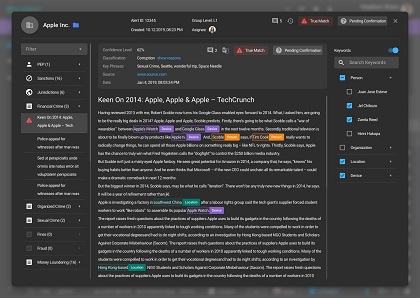

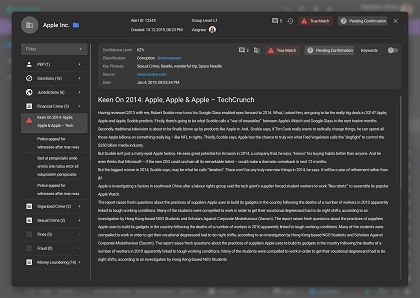

Go beyond simple keyword matching in a text passage – interpret an entity’s role in a situation, the nature and severity of the issue, and the involvement of multiple parties, by applying natural language processing and contextual analytics. Enable the system to evaluate cases and reduce research time.

Overarching assessment of truth

Reconcile facts from conflicting accounts, assess the accuracy of different sources, and correctly isolate parties with similar identifying information. Leverage a knowledge graph, data source management, machine learning, and entity resolution to develop the most definitive viewpoint.

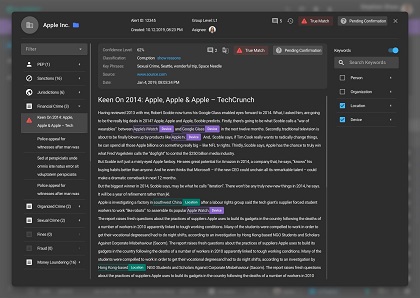

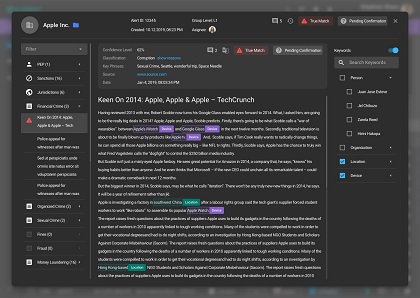

Comprehensive information sources

Some solutions rely solely on licensed DBs and public search engines; this leads to information gaps and bias. Instead, access over 80 million sources and billions of passages, going back 7 years. Ensure emerging or buried stories are recognised early.

Composite AI

Layer multiple AI technologies for powerful insights that reflect and enhance the decision-making of subject matter experts. Leverage knowledge graphs, natural language processing, machine learning and more. Automate routine decisions and guide analysts on complex situations.

Intelligent alerts

Machine learning observes and adapts to analysts’ treatment of alerts and, in conjunction with user-defined behavioural weightings, more accurately prioritises future alerts.

Seamless integration with KYC and Risk Management

Benefit from the integrated intelligence and risk management efficiencies of 360° customer assessment and investigation handling in ELEMENT of Compliance or optionally use only AMM - either way integrated with your existing risk and compliance systems and data.

ELEMENT of Compliance monitors, categorizes and prioritises entity-related news, by leveraging Natural Language Processing, Contextual Analytics and Machine Learning.

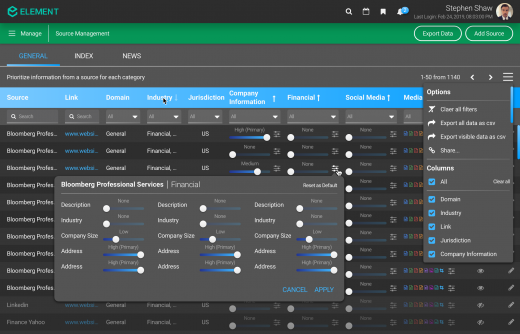

ELEMENT of Compliance lets analysts define a rating for a media source's general accuracy and reliability.

Adverse Media Monitoring is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations