ELEMENT of Compliance™

based on client implementation results delivered by ELEMENT of Compliance

Reduction in Compliance OpEx

Vendor data cost reduction

Reduction in alerts

Reduction in CapEx

Time-to-value acceleration

Rapidly changing regulations have led to an increase in the cost of compliance for banks. At the same time, banks are dealing with sophisticated money laundering, terror financing and fraudulent plots, while confronting technological obsolescence. With growing concerns around the financial penalties and reputational damage that this could impose, organisations are searching for advanced solutions that provide insight, efficiency and flexibility.

BlackSwan Technologies has emerged as a technological leader in the compliance space, being named as a KYC/AML category leader by Chartis Research, Risk.net Product of the Year 2021 Winner, RegTech Insight Award Winner, and Recognised Pioneer and Market Leader in Composite AI by Gartner.

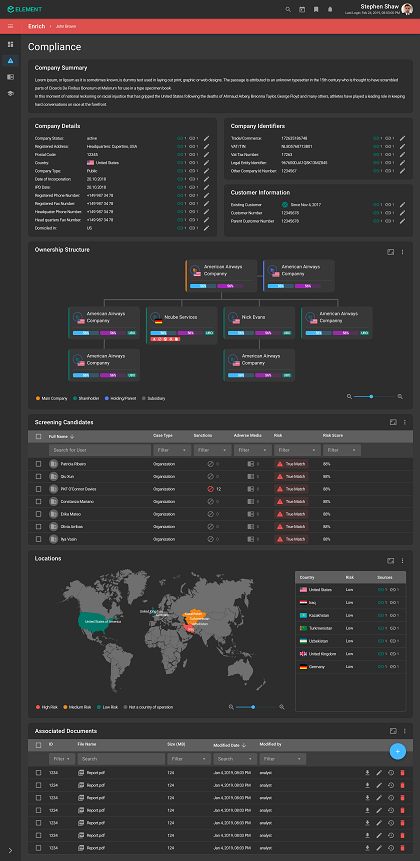

BlackSwan’s complete suite of capabilities are made available via ELEMENT™ of Compliance, a software application that sits atop AI-powered, enterprise software platform and integrates with existing data infrastructure and applications to provide a comprehensive solution.

BlackSwan’s advanced platform ELEMENT of Compliance™ challenges traditional enterprise software approaches by combining all available sources of information with AI/Cognitive Computing capabilities to automatically infer insights, strengthen team decision-making abilities and enhance operational efficiencies. Built-in machine learning means that the application automatically adapts with experience and new patterns.

ELEMENT of Compliance has a highly modular architecture for flexibility, so you can choose between an end-to-end enterprise solution or a bespoke set of capabilities integrated with your existing compliance technology.

The solution provides complete CLM/KYC/AML processing for the greatest synergies in intelligence and operations. At the same time, it is based on vendor-independent infrastructure, allowing for integration and parallel operation of existing data and technology assets. ELEMENT of Compliance is a cloud-agnostic solution, engineered to deliver the fastest time to market, military-grade security, and unlimited scalability, with low cost of ownership and minimal CAPEX.

Read more about a global bank using ELEMENT of Compliance here.

The application delivers unique advantages in a number of compliance functions. Click on the corresponding area to find out more.

KYC

● Customer profile enrichment using natural language processing-enabled data extraction, resulting in 35%+ efficiency gains

● Real-time client risk score calculation based on customer profile

pKYC

● Moving away from capacity-intensive periodic review operating models results in ~60% reduction in cost of remediation

● Customisable workflow engine and proven Event Detection and Analytics engine

Screening

● Comprehensive screening universe enabling firms to deploy quickly with pre-integration to hundreds of watchlists

● Best-in-class entity resolution helping to dramatically reduce false positives when distinguishing named parties

Adverse Media Monitoring

● Access over 80 million sources and billions of passages

● Automatically interpret an entity’s role in a situation, the nature and severity of the issue

Transaction Monitoring

● Detection of simple and complex networks of shell companies by analysing transactional activities, UBOs, addresses, etc.

Transaction Intelligence

● Derivation of risk scores via models tailorable to specific risk management requirements, including legal jurisdiction

● Visualisation and discovery of relationships and hidden patterns inferred from millions of transactions

Transactional and other relevant activity data are routinely scanned and a customer’s profile is constantly enriched with open-source data to identify emerging compliance risks.

The key technological features of ELEMENT of Compliance include:

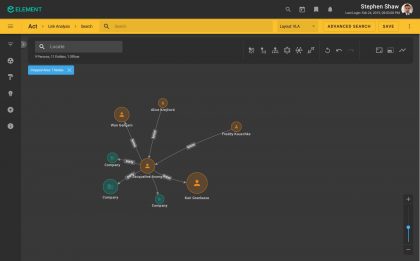

Automated AI and knowledge graph-based entity resolution and relationship identification mean that as an entity acts or new information becomes available, the knowledge graph evolves to reflect the most up-to-date state of intelligence.

In addition, enterprises can draw upon BlackSwan’s Intelligence Discovery toolkit to achieve a deep and rapid understanding about behaviours among entities being monitored. The toolkit includes:

BlackSwan Technologies offers our users operating model flexibility, with the following features:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations