ELEMENT of Compliance – Screening

Watchlist Screening of individuals and entities may be considered a fundamental, even straightforward, aspect of financial crime compliance. However, recent developments have raised the stakes for financial institutions:

Concern over growing penalties is increasing demand for labour to distinguish between entities with similar identifying information.

need to be incorporated in screening but are difficult to identify using traditional search techniques.

BlackSwan Technologies ELEMENT of Compliance provides a comprehensive set of watchlist screening features, such as hundreds of pre-integrated sources. Notably, the platform incorporates leading AI technologies, to deliver the most dramatic improvements to metrics that matter – more comprehensive entity coverage, reduction in false negatives and positives, and timely escalation.

ELEMENT of Compliance has been recognized by Chartis Research, an industry analyst firm dedicated to risk and compliance, in its RiskTech 100 rankings as a leading solution in the AML/KYC sector. Chartis took special note of the innovativeness of the application technology, particularly its AI-based “entity resolution” capabilities when distinguishing entities across data sources with similar identifying characteristics. One BlackSwan client, a global bank, increased entity resolution accuracy from 89% to 99.7%.

Comprehensive screening universe

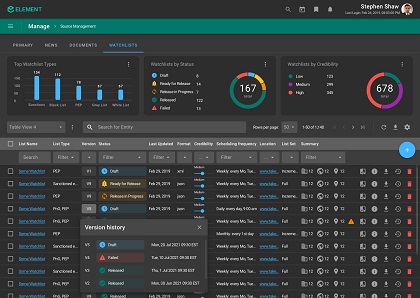

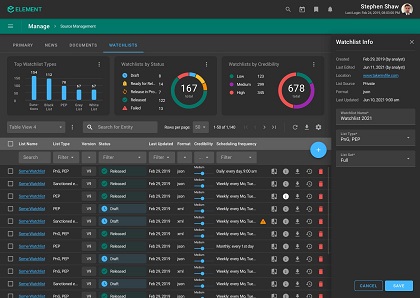

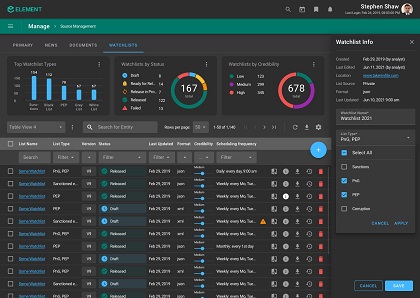

Deploy quickly with pre-integration to hundreds of watchlists. Add and manage any number of standard or custom watchlists.

Flexible list management

Create any number of watchlists and connect to any source and any format, internal or external, industry-standard or unique.

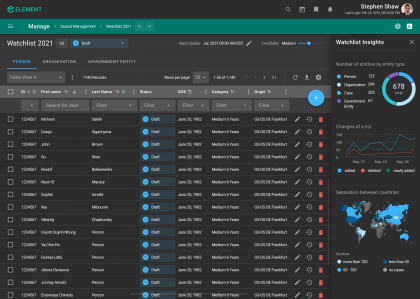

Best-in-class entity resolution

Dramatically reduce false positives when distinguishing entities with similar identifying information.

Broadest assessment of related parties

Automatically discover relationships and activities that connect your customers to all types of associates, including Ultimate Beneficial Owners, and screen them against watchlists too.

Concurrent screening of all sources

Realise highly-scalable processing with consolidated findings in real-time for efficiency.

Integration with a complete AML/KYC solution

Manage all data sources; perform adverse media and transaction monitoring; enrich entity profiles, configure multi-dimensional risk scoring that applies machine learning; define workflows – holistically with ELEMENT of Compliance.

Add and manage any number of standard or custom watchlists.

Efficiently review list insights at a macro, source level, as well as entity-by-entity.

Screening is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations