ELEMENT of Compliance – Transaction Intelligence

The timely investigation of alerts resulting from transaction monitoring systems is mandatory for regulatory filings such as Suspicious Activity Reports (SARs). However, financial institutions face obstacles that lead to a backlog of cases:

due to unproductive scenarios, such as duplicate cases, which are common and time consuming.

that involve the consolidation and analysis of information.

due to the lack of integration of KYC information and open source intelligence during investigations.

To avoid the penalties and operational consequences of not investigating legitimate cases on time, financial institutions need a more advanced approach with improved precision and efficiency.

BlackSwan Technologies’ ELEMENT of Compliance is an industry-leading KYC/AML solution recognised by Chartis Research for its innovative use of artificial intelligence and data visualisation, which improves the precision and efficiency of the investigation process.

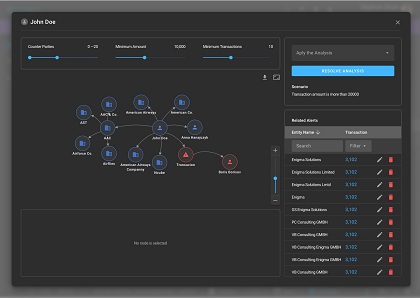

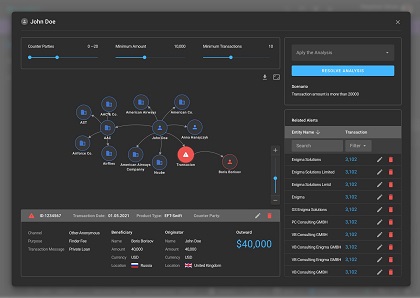

The system’s Transaction Intelligence capability centres on the creation of a highly-enriched, 360° view of an entity, its activities and relationships. After gathering entity information from various internal and external sources, ELEMENT presents them to the analyst in the context of the case being investigated. Moreover, ELEMENT visualises and discovers relationships between the entities involved in transactions, identifies the relevant risk factors, and derives risk scores in order to identify red flags. It also reduces investigation time by 80% through automated entity enrichment.

To improve the efficiency of the case investigation process, ELEMENT allows analysts to tailor and streamline investigations according to their specific requirements through workflows and case management, while facilitating escalation and collaboration.

The Transactional Intelligence module can operate synergistically with ELEMENT of Compliance’s screening, transaction monitoring, risk management, and KYC capabilities; or alternatively, integrate as an investigation tool with an organisation’s existing AML systems.

Risk Scoring

Derivation of risk scores via AI models tailorable to specific risk management requirements, including legal jurisdiction, while combining risks from processes such as KYC and watchlist screening to create a single customer risk view.

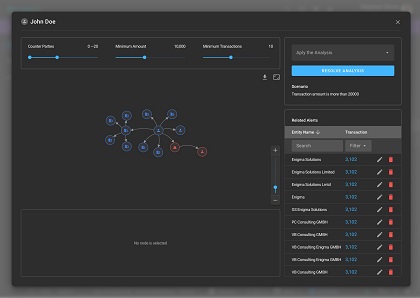

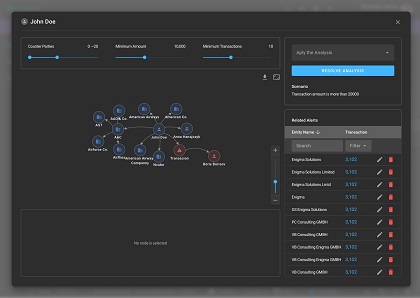

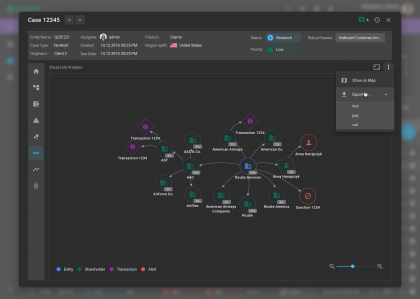

Visual Link Analysis

Visualisation and discovery of relationships and hidden patterns inferred from millions of transactions; consolidating data fragments residing in multiple silos to increase both effectiveness and efficiency of the investigation.

Workflow & Case Management

Bespoke case management with customisable flow and roles management, allowing AML analysts to tailor the investigation process, including questionnaires and messaging; while enabling escalation, collaboration, case auditing, and SAR filing.

Transaction Intelligence provides a full repertoire of capabilities including Visual Link Analysis, dashboards, presentation of transaction statistics and alert investigation tools.

Knowledge graph technology enables you to enrich information about counterparties, and discover and visualise relationships between these parties and counterparties.

Transaction Intelligence is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations