ELEMENT of Compliance – KYC

There is a divide growing between what regulators expect for Know Your Customer compliance and what is feasible using manual, resource-intensive solutions for compiling and screening compliance-relevant data. Financial services organisations are facing the following challenges:

for the high volume of information available , limited integration with multiple sources of truth and a lack of real-time and accurate single holistic view of customer identifying data and associated risk category.

with larger fines, frequent audits and varying regulations that require additional attributes and changes to workflows.

and risk assessment due to traditional KYC processes aggregating information incrementally.

To ensure adherence to the highest level of regulatory compliance, financial institutions should ensure that they have the required KYC capabilities.

BlackSwan’s ELEMENT of Compliance has been recognised as a leading solution in the KYC/AML sector by Chartis Research, and was named as the Best KYC Solution for Client On-Boarding, in the RegTech Insight Awards 2021.

BlackSwan creates an extensive enriched entity profile view at the beginning of the KYC process is a paradigm shift from the traditional KYC process of aggregating information incrementally. This subsequently leads to a much faster time to complete KYC, speedier risk assessment and overall improved client experience.

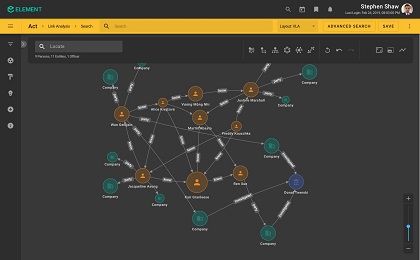

At the heart of BlackSwan’s approach to compliance is a knowledge graph that builds, in real-time, a comprehensive representation of all relevant entities and the relationships between them. As such, the vital data obtained during KYC is viewed as seed data, which is enriched using a variety of social media, global news and other unstructured sources to ensure all relevant details are included in each entity’s profile. As an entity acts or new information becomes available (e.g., adverse news), the knowledge graph evolves over time to reflect the most up-to-date state of intelligence.

Cost savings

~ Up to a 65% reduction in compliance operating expenditure (OPEX) due in part to automated sourcing and aggregation of client information.

Customer profile enrichment

Enrich profiles through natural language processing-enabled data extraction, resulting in 35%+ efficiency gains.

Connect with 400 primary data sources

Covering 70+ jurisdictions, major global data vendors, 85M+ websites and 1.3B + articles and journals.

Modular architecture

KYC can be deployed as a standalone solution, as well as part of a comprehensive integrated solution along with other core Compliance components such as Watchlist Screening & Adverse Media Monitoring and Transaction Intelligence, with all sources and components viewable on the entity page.

Rapid deployment

Adhere to compliance deadlines, through customisation of application logic without technical expertise, pre-built data source connectors, out-of-the-box insights, and a Software-as-a-Service option.

Composite AI

Layer multiple AI technologies for powerful insights that reflect and enhance the decision-making of subject matter experts. Leverage knowledge graphs, natural language processing, machine learning and more. Automate routine decisions and guide analysts on complex situations.

ELEMENT of Compliance is equipped with automated AI and knowledge graph-based entity resolution.

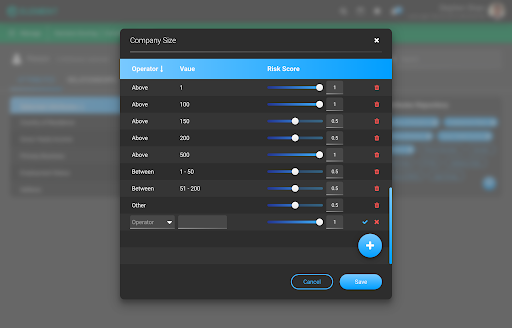

Organisations can use a customisable risk score model.

KYC is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations