ELEMENT of Compliance – pKYC

Traditional Know-Your-Customer (KYC) processes are limited both from a technological and process perspective. In particular, one-time or infrequent, batch KYC monitoring is both inadequate and costly. Financial services organisations are facing the following key challenges:

Outdated customer information which is not in sync with prevailing KYC policy requirements.

KYC portfolio risk assessment is based on dated information leading to wrong effort estimates and timelines being used.

Multiple manual workflows and processes are used and there is no feedback loop for ongoing remediation operations, resulting in a higher cost of operations.

Financial institutions are taking new approaches to future-proof their KYC Operating Model.

Existing KYC challenges can be resolved through a holistic operating model which would be based on BlackSwan Technologies’ Event Driven Review (EDR) capability; which solves key technological impediments. EDR is a core component of BlackSwan’s pKYC (perpetual KYC) solution, with the following benefits:

Futureproof operating model

Transformed operating model based on EDR, helping the organisation to move away from periodic KYC reviews and facilitate near real-time updates of their back book, enabling proactive risk assessment.

Seismic reduction in OPEX

Moving away from capacity-intensive periodic review operating models results in ~60% reduction in cost of remediation.

Unlimited KYC profile refreshes

Potential to refresh an unlimited number of corporate KYC profiles on a monthly basis. This is far more effective than the one-to-three year periodic reviews that many firms currently use.

Customisable workflow engine

Bespoke end-to-end KYC remediation workflow orchestration.

Proven Event Detection and Analytics engine

The engine is combined with data sourcing and management, and dynamic case management.

Real-time entity and portfolio risk assessment analysis

Extensive risk classification and scenario analysis using inbuilt risk engine for real time client and portfolio risk assessment.

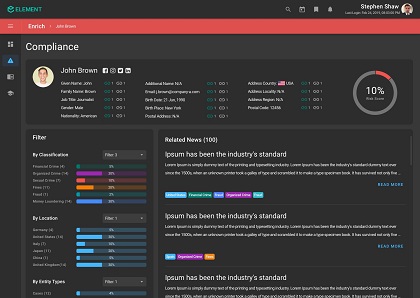

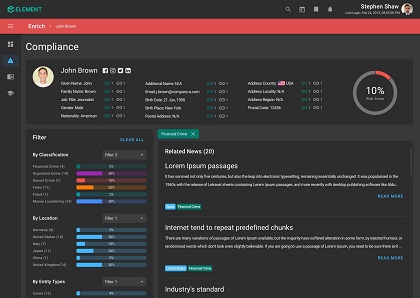

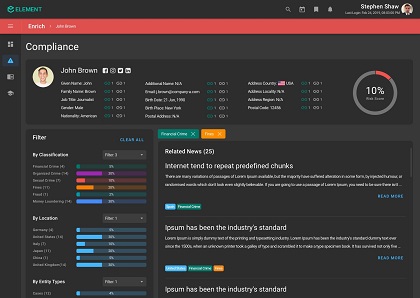

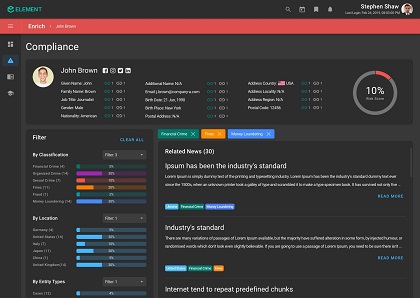

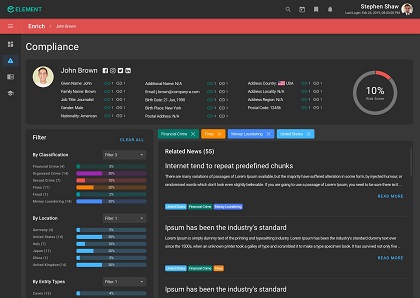

Enrich your customers' profiles and find discrepancies between different sources.

See a real-time version of a customer profile and be alerted to information that needs verifying or updating.

pKYC is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations