ELEMENT of Compliance – Transaction Monitoring

Transaction monitoring is an integral part of the AML procedures applied to combat financial crime. However, the explosive growth in transaction volume has exacerbated several challenges:

are making investigations more time-consuming and cost intensive.

as criminals continuously adapt their behaviours.

customer activity and report suspicious behaviour within a reasonable time frame.

Additionally, financial institutions are facing heightened regulatory scrutiny. Thus, an advanced approach is imperative to enhance continuous monitoring and improve regulatory compliance. Moreover, new models and scenarios need to be more rapidly developed, tested and deployed.

BlackSwan Technologies’ ELEMENT of Compliance is an industry-leading KYC/AML solution recognised by Chartis Research, combining conventional rule-based transaction monitoring with the latest sophisticated AI techniques. To account for the shortcomings of standard rule-based monitoring solutions, ELEMENT introduces relationship-based monitoring and behaviour-based monitoring. Relationship-based monitoring discovers complex networks of shell companies that support money laundering on a global scale, which are often difficult for conventional systems to detect. Plus, behaviour-based monitoring counters launderers’ efforts to remain undetected by rule-based scenarios in standard AML solutions.

The benefits above are achieved through a combination of AI technologies, including knowledge graphs and machine learning. With ELEMENT’s approach, financial institutions significantly reduce false positives while minimising regulatory risks and compliance costs.

Relationship-based monitoring

Detection of simple and complex networks of shell companies by using transaction and customer information, as well as data from open source intelligence and paid sources, to analyse transactional activities, UBOs, addresses, etc. via knowledge graph link analysis.

Automated entity segmentation/clustering

Categorisation of originators and beneficiaries (with or without KYC information) based on their profile, banking activities, and business type using machine/deep learning; and thereafter, score and monitor their risks.

Behaviour-based monitoring

Detection of suspicious activities by using pre-defined explainable and creatable features that are based on money laundering and terrorist financing behaviours, greatly reducing the false-positive alert ratio and decreasing the overall risk.

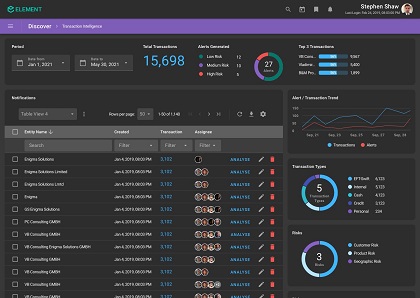

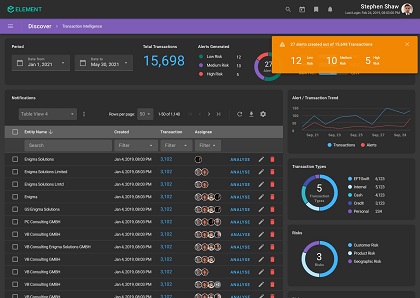

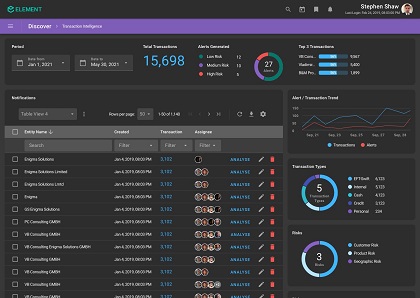

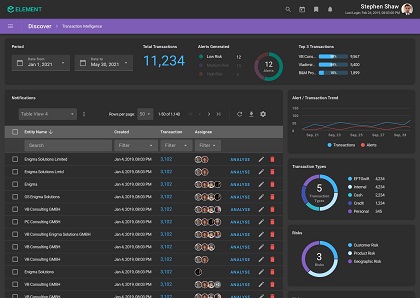

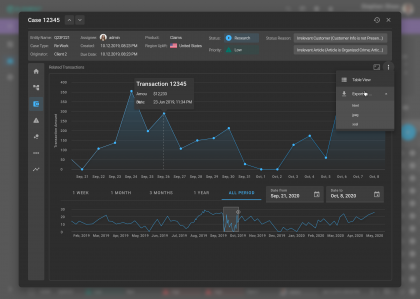

ELEMENT of Compliance’s Transaction Monitoring generates alerts based on a set of rules and scenarios defined by analysts.

Visualise and monitor transactions in real time, compare activities of peer groups and highlight outliers.

Transaction Monitoring is a core component of BlackSwan Technology’s ELEMENT of Compliance™. The solution addresses the full range of capabilities to support and augment financial crime compliance, including:

ELEMENT™ of Compliance

Delivering an end-to-end financial crimes compliance process and leveraging advanced AI, this application addresses requirements for Know Your Customer, Anti-Money Laundering, Anti-Fraud, Watchlist Screening, Adverse Media Monitoring, and Transaction Monitoring & Intelligence, while dramatically increasing operational efficiencies.

KYC on Demand

Know Your Customer: KYC on Demand is a high-performance, high-security global solution that will allow your team to continue to onboard new customers, sell products and meet KYC obligations from anywhere in the world

Market Intelligence

The first autonomous, continuously-evolving index of companies with comprehensive, customisable profiles and analysis.

ELEMENT™ of Marketing

Gain new insights into customer behavior while personalising their user experience throughout the customer journey.

Underwriting

This application covers the entire underwriting process from identifying and quantifying the risks and exposure associated with potential clients, through negotiating with the customer on coverage cost, to analyzing complete markets, and beyond

Cyber Underwriting and Threat Intelligence

By continuously monitoring cyber events, and understanding the risks associated with existing and potential clientele, this application quantifies cyber risk, potential attack vectors, and offers mitigation plans

E-Discovery

A complete framework to support the identification, preservation, collection, processing, review, analysis and production of digital data in order to sustain mission critical business processes.

Risk

Detecting and quantifying different aspects of risk related to an enterprise operation, recommending policies for risk mitigation, and promoting offerings to address them.

Asset Tracing

This forensic accounting application allows tracing assets hidden in piles of data, and supports their recovery

Innovation hub

Bring in your secret sauce! ELEMENT™ allows you to easily develop new applications, utilize them commercially, and offer them to other organizations